Financial Markets Are a Key Institution of Growth Because

Without them there would be no incentive to invest. They allow people to plan better for retirement.

Best Analytical Report On Glass Packaging Market Including Growth Factors Overview And Opportunity Assess Glass Packaging Business Growth Innovative Packaging

Chapter 17 Banking and the Management of.

. Institutions as a Fundamental Cause of Long-Run Gmwth 389 Of primary importance to economic outcomes are the economic institutions in soci- ety such as the structure of property rights and the presence and perfection of markets. Investor confidence stabilizes the economy. Without financial markets borrowers would have difficulty finding lenders themselves.

They move funds from those who save to those who invest. Emphasis on financially-savvy management skills. Financial markets are a key institution of growth because.

Without them people would not save. Because the assets are primarily financial their value can be quite volatile. The stock market is just one type of financial market.

Financial markets create liquidity that allows businesses to grow and entrepreneurs to raise money for their ventures. PRIMARY SECURITY MARKETS Secondary markets are the main focus of this chapter because most investors buy and sell securities via secondary markets. Financial markets are a key institution of growth because.

Because the assets and liabilities are different claims it is possible for the value of the assets to drop resulting in an insolvent institution insolvency risk. If per capita output falls by 2 percent and population grows by 3 percent output. Grows by 1 percent.

A modern financial system offers different types of financing depending on a corporations age and the nature of its business. Hedge funds have more in common with investment banks than with any other type of financial institution. Hedge funds are not as highly regulated as.

Financial markets are made by buying and selling numerous types of financial instruments including equities bonds currencies and derivatives. They move funds from those who save to those who invest. They move funds from those who save to those who invest.

View Test Prep - chapter 17 study guide for financial markets and institution from FIN 4303 at University of South Florida. ECO 2115 Chapter 11 review Questions Why Study Financial Markets Multiple Choice Sample Question Answer. Hedge funds are legal in the United States but they are not permitted to operate in Europe or Asia.

Why do nonfinancial corporations need modern financial markets and institutions. Financial markets are a key institution of growth because. Financial markets attract funds from investors and channel them to enterprises that use that capital to finance their operations and achieve growth from startup phases to expansioneven much later in the firms life.

Robert Shiller Enroll Now An overview of the ideas methods and institutions that permit human society to manipulate risks and foster enterprise. Financial Markets 48 Stars 13556 ratings Instructor. There is a strong positive relationship between financial market development and economic growth.

The simple response is that well-developed smoothly operating financial markets play an important role in contributing to the health and efficiency of an economy. Financial Markets and Institutions Final Exam Spring 2007 Bonham Answer the following essay questions in three to four blue book pages or less. They reduce risk by having information publicly available to investors and traders.

Economist Hernando DeSoto believes that the lack of formal property rights. Economic institutions are important because they influence the structure of economic incentives in society. Be sure to fully explain your answers using economic reasoning and any equations andor graphs needed to make your point.

Financial markets are a key institution of growth because. They move funds from those who save to those who invest. In conclusion financial institutions possess a vibrant role in the financial markets and accelerate the development of financial crises because of their activities.

Grows by 1 percent. Figure 2 shows a demand curve D and a supply curve S where the supply of capital includes the funds arriving from foreign investors. View Test Prep - Why Financial Markets Answer Key from ECO 2115 at University of Ottawa.

Suppose that a business discovers an opportunity that requires funds to exploit. Suppose that a business discovers an opportunity that requires funds to exploit. Draw a diagram showing demand and supply for financial capital that represents the original scenario in which foreign investors are pouring money into the US.

The contribution of financial markets in this area is a necessity for maintaining the competitiveness of an economy today given the strongly increased international competition rapid technological progress and the increased role of innovation for growth performance. The reason is straightforward. Asymmetric Information and Financial Crises 40.

So most of the investment industry is focused on secondary markets. These markets calm the economy by instilling confidence in investors. Description of practices these days and evaluation of potentialities for the future.

But first we discuss primary markets which. If per capita output falls by 2 percent and population grows by 3 percent output. Corporations need access to financing in order to innovate and grow.

Furthermore financial institutions act as an intermediary thereby they decrease transaction costs and risk and simultaneously increase efficiency through information processing. For example in Chapter 1 of their 2001 book Financial Structure and Economic Growth editors Demirgüç. Served by these markets and what characterises well-functioning financial markets.

As a result risk management is crucial at todays financial institution.

Credit Union Vs Bank The Differences Credit Union Marketing Credit Unions Vs Banks Credit Union

Global Water Desalination Market To See An Exclusive Growth Of Us 27 Bn By 2025 Increasing At Cagr Value Of 7 8 While Key Pla Marketing Trends Suez Marketing

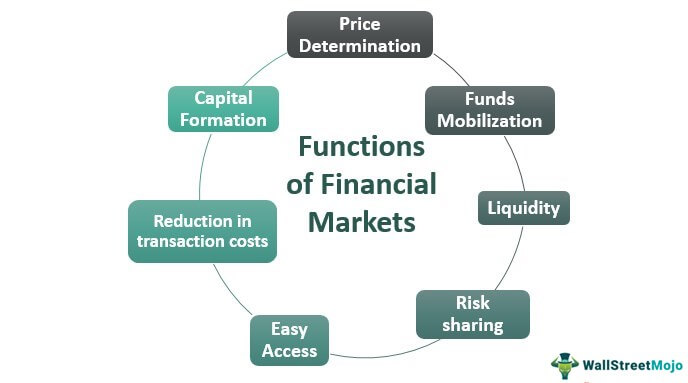

Functions Of Financial Markets List Of Top 7 Financial Market Functions

Anti Money Laundering Software Market Global Industry Analysis 2018 2025 Latest Technology Updates Bank Secrecy Act Money Laundering

Pin By Bibi On Gugajajnvc Financial Institutions Financial Federation

The Rise Of Man Shopping In Five Studly Charts Man Shop Chart Fashion Buyer

Nbfc Registration Grow Business Financial Institutions Loan Company

Functions Of Financial Market Top 5 Functions Of Financial Market

Webinar Webinar Intervention Finance

Qualitative Report On Food Additives Market Cagr Status Market Synopsis Market Surge Regional Outlook Growth P Swot Analysis Food Additives Global Recipes

Jaiz Bank Expects 316m Profit In Q2 2017 Banking Banking App Bank

Financial System Meaning Components Functions

Liquidity Asset Liability Management Solutions Market In 2022 Asset Liability Management Solutions Data Security

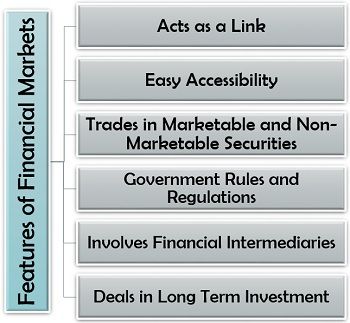

What Is A Financial Market Definition Example Features Composition Types Functions The Investors Book

Key Players In The Capital Markets Capital Markets 101

What Is A Financial Market Definition Example Features Composition Types Functions The Investors Book

Digital Money Transfer Market To Witness A Pronounce Growth During 2025 Key Players Huawei Infosys Edgeve Growth Strategy Business Intelligence Making Goals

Payment Security Market Key Drivers Business Insights Trends In 2022 Marketing Security Payment